- Sonoma County Insider

- Posts

- Wine Country Real Estate: Where Your Parents' Death Determines Your Future

Wine Country Real Estate: Where Your Parents' Death Determines Your Future

Sonoma County's crab feeds are accidentally revealing which communities have the social infrastructure that makes luxury markets actually work, the $25 trillion inheritance tsunami is creating a wine country where your parents' death might determine whether you ever own property here at all, and Healdsburg just split into three completely separate real estate universes where a $775,000 home and a $4.5 million estate might as well exist on different planets.

It’s officially crab season here in Sonoma County

Twenty-five all-you-can-eat crab feeds raising hundreds of thousands for local organizations between January and February aren't just winter tradition—they're live proof of the civic infrastructure and community bonds that lifestyle investors claim to want but rarely know how to evaluate before buying.

The Great Wealth Transfer dropped $6 trillion into American real estate in 2025 alone, with 96% of luxury buyers now paying cash while first-time buyers hit age 38 trying to crack the market, fundamentally splitting Sonoma County into inherited-wealth havens and everyone else fighting for table scraps.

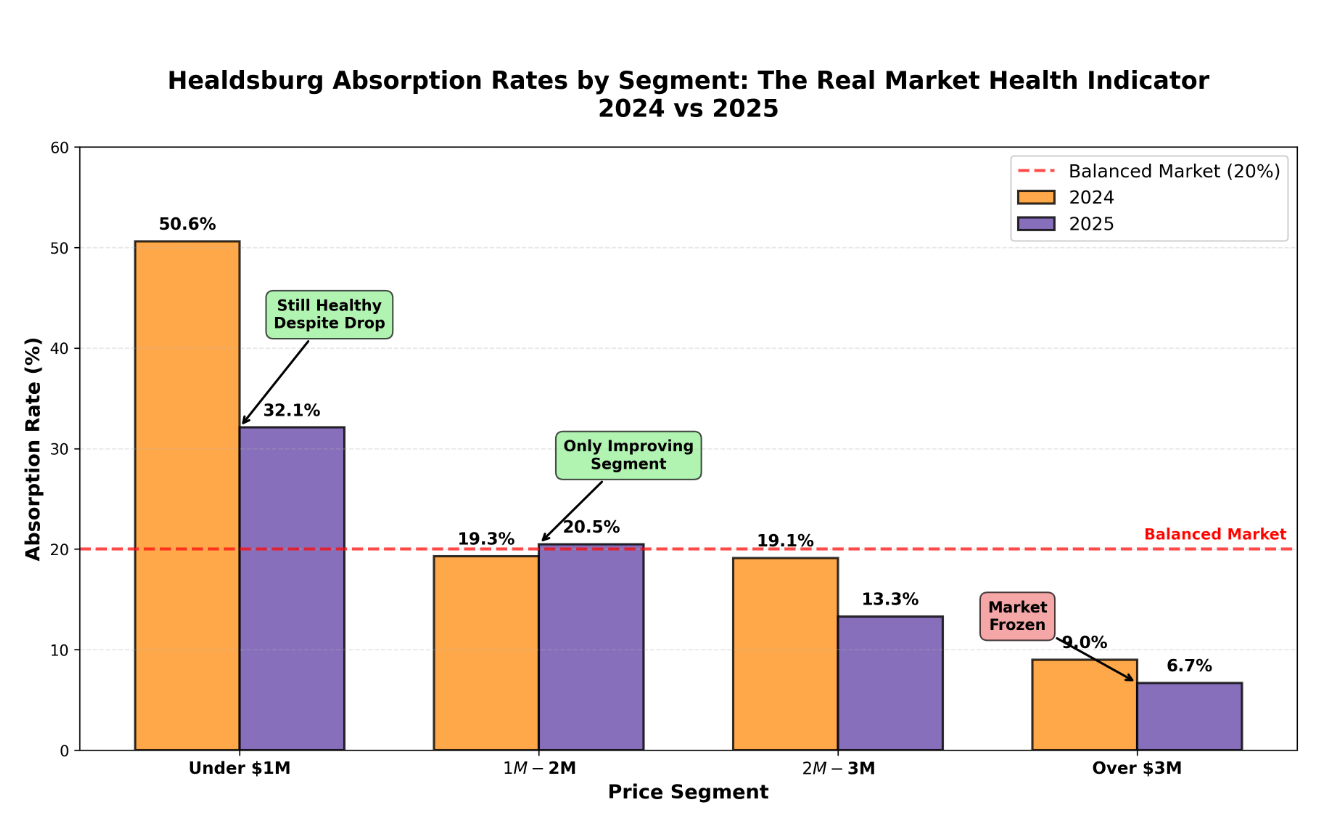

Healdsburg's sub-$1 million market absorbed a 36% inventory surge while luxury listings above $3 million are sitting on nearly two years of supply, proving that wine country's appeal hasn't dimmed but its pricing tolerance absolutely has.

Pour yourself something strong and settle in—this week's stories explain why wine country real estate stopped making sense to anyone operating without a trust fund or a serious reality check.

If you were sent this newsletter by a friend, you can get your very own copy by signing up here

Real Estate News

Healdsburg's 2025 Real Estate Market: Three Markets, Three Different Stories

Forget what you've heard about "the market"—Healdsburg doesn't have one anymore. We've got three, and they're playing by completely different rules.

Here's what closed out 2025: 185 homes sold, up 7% from last year. Median price hit $1.15M, down 5.5%. Sounds like typical cooling, right? Wrong. These numbers hide the most fascinating market split we've seen in years.

The Real Story: It's All About Where You're Shopping

Nearly 80% of Healdsburg's action happens under $2M—that's 146 of 185 sales. The remaining 21% (just 39 transactions) happened above that mark. Four out of five Healdsburg buyers are shopping in a completely different market than the luxury segment everyone keeps talking about.

Under $1M: The Resilient Workhorse

This is Healdsburg's backbone—45% of all sales, 83 homes that actually closed.

Days on market jumped to 80 from 57 (weekend bidding wars are gone)

Inventory surged 36% to 286 properties

But months of supply actually improved from 4.7 to 4.0 months

Median price: $775K (down just 1.8%)

More inventory but less supply? Exactly. Strong demand is absorbing everything sellers throw at it. The 32.1% absorption rate means roughly one in three homes sells monthly—two to five times better than luxury segments.

For buyers priced out before, this is your moment. For sellers, price it right from the start and you'll find serious buyers.

The $1M-$2M Sweet Spot: Healdsburg's Winner

While every other segment struggled, this range grew 19%.

63 sales (10 more actual transactions)

Fastest selling at 71 days

Sellers getting 95% of asking

New listings down 11%

This segment nails everything: wine country living, walkability to town, and a price point successful professionals can reach. It's no wonder this represents over one-third of all transactions.

Above $2M: Two Segments, Same Struggle

Both ranges share one brutal stat: zero sales growth despite massive price adjustments.

The $2M-$3M segment closed 14 deals in 2025. Same as 2024.

Inventory up 32%

10.1 months of supply

Only 13.3% absorption rate

Above $3M, the pain is sharper. Same 25 transactions, but:

Median fell 20% to $4.54M (that's $1.15M less)

Sitting on 18.8 months of inventory

Just 6.7% absorption rate

Price per square foot down 16%

These aren't minor adjustments—they're corrections. Days on market "improved" to 94 from 160, but only deeply discounted properties are moving.

What Changed: Pricing Got Real

Sellers finally embraced reality. Properties sold at 91.8% of original list price versus 90.1% in 2024. That discipline kept overall days on market flat despite softening—proof that realistic expectations prevent listing stagnation.

The Bottom Line

Healdsburg's appeal hasn't diminished—different price segments just need different strategies now.

Shopping under $2M? You're in a market with solid fundamentals and 146 of 185 transactions. Competition exists but it's rational, not frenzied.

Above $2M? Expect to negotiate 10-20% below asking. With nearly two years of inventory above $3M, patience pays.

The wine country dream is alive and well. It's just gotten segment-specific.

Want the full breakdown with negotiation tactics, pricing formulas, and segment-specific strategies for each price tier? Read our complete analysis on our blog.

Local News

Sonoma County's $3M Crab Economy Reveals Hidden Investment Signal

California's Dungeness crab fishery is serious business. The West Coast hauled in 75-80 million pounds in 2024, with prices hitting $3-4 per pound as supply tightened. Bodega Bay, one of the state's key commercial ports, anchors a maritime economy that keeps coastal communities humming despite whale entanglement delays that pushed the 2025-26 season opening to January 15, 2026.

But here's where it gets interesting for Sonoma County real estate watchers: that multimillion-dollar ocean harvest transforms into the region's most beloved winter social calendar.

Crab Season Meets Community Capital

Over 25 all-you-can-eat crab feeds hit Sonoma County between January and February, turning fresh-caught Dungeness into engines of fundraising, networking, and community connection. These aren't just dinners; they're where local business owners, nonprofit leaders, and residents gather over buttery cracked crab to strengthen the social fabric that makes Sonoma County such a draw for lifestyle-focused investors.

The Numbers Behind the Tradition

Russian River Rotary's 95th Annual Feed (January 24): All-you-can-eat crab, pasta, and auction action

Sonoma County Farm Bureau's Great Sonoma Crab & Wine Fest: The state's largest crab event, raising funds for agricultural education at $165 per person

Rohnert Park Chamber Feed (February 14): $85-95 tickets supporting local business development

Sonoma County Democratic Party's 38th Annual Feed (February 27 at Graton Resort): $80 per person with Sonoma wines

Becoming Independent Crab Feed (February 28): Unlimited crab, beer, wine, and live auction at $100

Collectively, these events raise hundreds of thousands annually for schools, scholarships, fire departments, and civic organizations.

Why Real Estate Investors Should Care

For those evaluating Sonoma County's lifestyle investment thesis, crab feeds offer tangible proof of community engagement. These events showcase:

Active civic infrastructure: Rotary clubs, chambers of commerce, and nonprofit networks that create social capital

Sustainable local economy: Commercial fishing ports like Bodega Bay provide year-round employment beyond wine tourism

Hyperlocal culture: Wine-country newcomers consistently cite tight-knit community bonds as a key quality-of-life factor

The feeds also function as unofficial networking hubs. Real estate professionals, vineyard owners, hospitality operators, and local government officials show up. For investors weighing whether Sonoma County offers genuine community connection beyond scenic views, spending $75-165 on a crab feed ticket is cheaper than a month of market research.

The 2026 Season Outlook

This year's events carry extra anticipation. California's commercial Dungeness season faced significant delays due to whale entanglement protections, with 95 large whales confirmed entangled in 2024 versus 64 in 2023. New CDFW regulations under the Risk Assessment and Mitigation Program mean three or more humpback entanglements trigger automatic delays.

The 2025-26 season finally opened January 15 in key zones with a 15 percent gear reduction, making January and February crab feeds a celebration of both maritime tradition and environmental adaptation. For investors tracking how communities respond to regulatory change, this adaptation pattern matters—Sonoma County didn't abandon its traditions when the delayed 2024-25 season saw only 8.5 million California pounds landed (well below historical averages). Organizations adapted and kept community bonds alive. For a region that prides itself on sustainability credentials, the balance between protecting marine life and preserving fishing livelihoods resonates with eco-conscious investors.

Where to Find Your Feed

Events span the county from Bodega Bay to Rohnert Park:

Tides Wharf Annual Crab Feed Series: Restaurant-hosted Fridays through February, $99.95 per person

Forestville Chamber Feed (January 24): Holy Ghost Hall in Sebastopol, $75

Sebastopol Masons (February 7): Family-style servings with takeout available

Bodega Bay Grange Crab Cioppino (February 15): All-you-can-eat cioppino, cold-marinated crab, noon-5 p.m.

Many sell out within days of tickets going live, particularly with the January feeds just around the corner. If you're planning to attend the Russian River Rotary or Forestville events on January 24, act fast—these typically move quickly once word spreads that fresh Bodega Bay crab is confirmed.

In a market where lifestyle ROI increasingly drives purchase decisions, the fact that Sonoma County can mobilize dozens of sold-out fundraisers around a single regional delicacy says something about community durability. That's the kind of intangible that doesn't show up in comps but absolutely affects long-term property values and rental demand.

Skip the theoretical research and grab a crab cracker.

Tech Trends

Voice assistants are making homes smarter (and more sellable)

Nearly half of adults under 55 use voice assistants regularly, and 40% of families with young kids already have smart speakers controlling lights, thermostats, and security systems. For sellers, this means pre-wired smart home features are shifting from "nice-to-have" to "expected" - especially for Bay Area buyers accustomed to tech-forward living. Homes in Windsor and Petaluma with integrated voice control systems are sitting on market 15-20% fewer days than comparable non-smart properties.

For buyers relocating from tech hubs, voice-enabled homes offer immediate lifestyle continuity. You're not starting from scratch when your Healdsburg cottage already talks to your existing ecosystem.

Your phone is now your most powerful home search tool

60-70% of buyers now use mobile devices during their home search, with half finding their actual purchase online. The implication for Sonoma County? Buyers are pre-qualifying neighborhoods, school districts, and commute times before ever contacting an agent. Properties with strong online presence - quality photos, virtual tours, detailed descriptions - capture buyers earlier in their decision journey.

Mobile-first buyers also expect instant response times and digital transaction capabilities, pushing the local market toward faster, more efficient processes.

AI search is getting scary good at reading your mind

Zillow, Redfin, and Realtor.com now use conversational AI that understands requests like "vineyard-view home under $1.5M with casita near downtown Healdsburg." These tools recognize "tiki bar" in photos and parse "natural wood siding" from descriptions - eliminating the frustration of rigid filter systems.

For Sonoma County's unique inventory (guest houses, wine storage, creek frontage), this semantic understanding helps buyers discover properties they'd miss with traditional searches. Sellers benefit when listings are described thoroughly - AI rewards specificity.

Speaking of smart systems, transportation is next- Waymo is coming to Sonoma County (yes, really)

California DMV approved Waymo's expansion across Northern California, explicitly including Healdsburg, Petaluma, and Rohnert Park. Service launches mid-2026, with robo-taxis operating on Highway 101 and local roads.

The real estate angle? Autonomous vehicles fundamentally change location value. Properties farther from SMART stations or Highway 101 on-ramps become more attractive when commute stress disappears. Sebastopol and western county locations - previously dinged for difficult access - gain appeal when your "driver" never gets tired or frustrated with winding roads.

The national autonomous vehicle market is projected to grow 30%+ annually through the early 2030s. Early-mover communities like Sonoma County will likely see property value premiums as buyers realize they can live deeper into wine country while maintaining Bay Area work connections. Homes with dedicated autonomous vehicle drop-zones or circular driveways may command premiums as the infrastructure matures.

For aging homeowners considering downsizing, robotaxis eliminate the "I can't give up my car" barrier to moving into walkable downtowns like Healdsburg or Sonoma's Plaza district.

Local News

The wine industry crisis you're not hearing about

When wine production drops 10%, the economic damage multiplies exponentially through specialized supply chains. Sonoma County's wine grape production value fell 12.6% in 2024 to $626.6 million, with harvest tonnage down 12.2% to 211,511 tons. But the real story is happening in businesses most people never think about.

Uprooted wine grapes are burned in to the night in a terraced vineyard

The invisible supply chain is collapsing

Every winery needs barrel makers, steel fabricators for custom tanks, equipment manufacturers, specialized brokers, and a whole ecosystem of family-owned suppliers. These businesses are reporting 30-50% revenue drops:

One equipment manufacturer is shipping excess inventory to Texas and Virginia wine regions just to stay afloat

A tank broker is pivoting to wastewater treatment because wine calls dried up

The family business making crush pad equipment is facing existential questions after decades serving the industry

Why wine hurts more than other crops

Wine industry activity generates higher multiplier effects because of tourism integration, manufacturing complexity, and specialized processing. Research shows viticulture and winemaking pull in way more suppliers than commodity crops. Translation: a wine industry contraction hits local economies harder than similar declines in simpler agricultural sectors like broccoli or wheat.

What real estate investors need to know

Wine represents 32% of Sonoma County's manufacturing jobs

The industry employs 1.1 million people nationally across 544 connected sectors, many concentrated here

About 30% of 2025 wine grapes are projected to go unsold

Roughly 5,000 acres of vineyards being pulled out

Vineyard land values showing distress at $70,000-$215,000 per acre

Tasting room visits dropped 14% in 2024, with early 2025 seeing another 8.4% decline

The silver lining that matters

Not all wine businesses are dying. Direct-to-consumer tasting room sales averaged $269 per visitor in 2024. Smaller wineries are proving they can be profitable at reduced scale. Some are finding creative cost savings - one eliminated foil capsules and saved $100,000. Premium segments like Sauvignon Blanc are still growing.

The real estate question

What does Sonoma County look like when the wine industry restructures? The glamorous tasting rooms will survive. But the family-owned barrel maker who's been here 40 years? The specialized equipment manufacturer with 28 workers across three companies? That irreplaceable expertise and those middle-class jobs are at serious risk.

This affects everything from school funding to nonprofit support to retail viability. The wine country most people never see is quietly being reshaped, and the economic multiplier effects extend far beyond vineyard property values into the broader real estate market and quality of life that makes Sonoma County attractive in the first place.

Area Guides

Wine Country Retirement: How Location Choice Costs You $1 Million

Your retirement dollar goes wildly different distances depending on which Sonoma County town you choose

We built a framework comparing eight retirement destinations across what actually matters: walkability, social scene, climate, and real money.

The math is brutal. A $1.5M Healdsburg home versus an $850K Windsor property creates a $1M+ gap in total ownership costs over 10 years when you factor property taxes, insurance, maintenance, and transportation. That's not chump change in retirement.

Watch our complete video guide to discover:

How location choice creates $1M+ differences in total ownership costs over 10 years

The "test drive" strategy for evaluating communities during peak and off-season

Why coastal Bodega Bay stays 10°F cooler than inland Cloverdale and what that means for your bills

Hidden costs nobody talks about: wildfire insurance, well maintenance, and car dependency expenses

How the seasonal living strategy works—own affordably while renting premium locations short-term

The smart money test-drive strategy

Spend 1-3 months living in different communities during both peak season and off-season before buying. What feels charming on a weekend visit might feel isolating come January when fog rolls in for weeks.

The real cost breakdowns nobody mentions:

Wildfire insurance premiums vary dramatically by location

Well maintenance for rural properties adds thousands annually

Car dependency in suburban areas means higher transportation costs

Seasonal tourism impacts which restaurants you can actually get into

The play for budget-conscious retirees

Own affordably in Windsor or Cloverdale ($500K-$800K savings versus Healdsburg) while renting short-term in premium locations during your favorite seasons. You get wine country proximity without the premium price tag—though you'll drive everywhere.

Healdsburg delivers walkable plaza dining and upscale culture. Sonoma brings 400+ wineries with slightly more affordability. Bodega Bay offers ocean access and coastal climate. Windsor and Cloverdale provide wine country access at half the price.

Our video series includes street-level town walkthroughs, retiree interviews sharing what surprised them, and cost calculators showing true 10-year differentials between communities.

Real Estate News

Wine Country's New Buyers: $25 Trillion Inheritance Wave Hits Real Estate

The largest wealth transfer in American history is rewriting the rules of real estate—and creating a market that works very differently depending on which side of the inheritance divide you're on.

$6 trillion changed hands in 2025 alone as Baby Boomers and the Silent Generation pass down assets. Through 2048, $124 trillion will flow to heirs, with $25 trillion specifically earmarked for real estate. The impact? Luxury markets are experiencing unprecedented booms while first-time buyers hit record ages just trying to enter the market.

The luxury numbers tell one story:

96% of luxury buyers pay cash, completely insulated from interest rates

National luxury threshold now starts at $1.2 million, ultra-luxury at $5.49 million

Martha's Vineyard median luxury prices jumped 72% to $8.74 million since 2016

91 billionaire heirs globally inherited $297.8 billion in 2025—up 36% from 2024

In Sonoma County, luxury real estate ($3.5M+) attracts inherited wealth from Bay Area tech fortunes and family trusts. These buyers understand real estate as multi-generational wealth storage with lifestyle benefits—exactly what wine country offers.

Craig Brody of Douglas Elliman captured the mindset: "These clients understand that buying real estate and holding it over time is not only great for personal enjoyment, but also good for continuing the generational cycle."

But the other side looks dramatically different:

Average first-time buyer age jumped from 35 in 2023 to 38 in 2024—oldest on record

44% of millennials willing to spend half their monthly income just to become homeowners

Gen Z homeownership sits at just 25%

The population under 35 is now the poorest on record

The math that worked for previous generations simply doesn't translate. A $60,000 house on a $40,000 salary represented a 1.5x income ratio. Today's $438,000 average home requires income multiples several times higher, even with lower interest rates.

For Sonoma County specifically:

The wealth transfer creates opportunities and challenges. Inheritors are upgrading primary residences, purchasing vacation properties in supply-constrained wine country markets, and treating real estate as portfolio diversification with tangible lifestyle benefits. This capital flow supports property values but also contributes to affordability pressure.

Financial advisors note that while the S&P 500 delivered 236% total return from 2016-2025 compared to luxury real estate's 72% gain, real estate offers something stocks cannot: a place to gather, create memories, and pass down family legacy.

Investment patterns attracting inherited wealth locally:

Healdsburg and Sonoma downtown properties

Vineyard estates with income-generating potential

Russian River vacation homes

Sebastopol properties offering both lifestyle and rental income

The Great Wealth Transfer is reshaping who can access homeownership and at what price points. For those positioned to inherit, wine country offers compelling lifestyle-investment combinations. For those building wealth independently, the market requires creative strategies—whether that's house-hacking, multi-generational purchases, or focusing on emerging neighborhoods before inherited capital arrives.

Understanding both sides of this wealth transfer helps explain why Sonoma County's market dynamics have shifted so dramatically—and why strategic timing and positioning matter more than ever.

Current Listings

What’s Happening This Week

Winter WINEland Weekend

Where: 60+ Participating Wineries in Healdsburg, Windsor, Sebastopol & Northern Sonoma County

When: Saturday–Sunday, January 17–18, 2026 • 11:00 AM – 4:00 PM

Why You Should Go: This is Wine Country's ultimate winter escape—hop from winery to winery across three valleys, sipping current vintages while taking in those stunning winter vineyard views. Think of it as your ticket to taste-test your way through 60+ tasting rooms with one weekend pass, meeting winemakers and discovering hidden gems you'd never find on your own.

The Peking Acrobats

Where: Luther Burbank Center for the Arts, 50 Mark West Springs Road, Santa Rosa

When: Tuesday, January 20, 2026 • 6:30 PM

Why You Should Go: Witness gravity-defying stunts, contortion, and acrobatics that'll make your jaw drop—this legendary troupe blends traditional Chinese music with high-tech special effects for a dazzling show that's perfect for the whole family. Think human chair stacks, trick cycling, and precision tumbling that pushes the boundaries of what the human body can do.

Jesse Sykes & The Sweet Hereafter

Where: Private Venue in Santa Rosa, CA 95401 (full address provided with ticket purchase: Undertow Shows are intimate, fan-hosted concerts in unique private spaces, creating one-of-a-kind experiences for artists and audiences alike.)

When: Wednesday, January 21, 2026 • Time TBA

Why You Should Go: This is the kind of intimate house concert experience you'll tell your friends about—Seattle's indie-folk queen brings her haunting vocals and The Sweet Hereafter to someone's living room (or cool private space). These Undertow shows are deliberately small and special, making you feel like you've stumbled into a secret session with one of the Pacific Northwest's most beloved artists.

Got friends dreaming of wine country life? Share this newsletter and save them from doomscrolling Zillow

Follow our somewhat professional adventures on Instagram @bruingtonhargreaves

Check our YouTube channel for weekly local market updates (and occasional winery mishaps)

David & Jonathan here – the guys who write about real estate but really just want to talk about our favorite taco trucks. Hit us up about anything Sonoma County (or beyond). Whether you're buying, selling, or just want to know which wineries actually welcome dogs – we've got you covered.